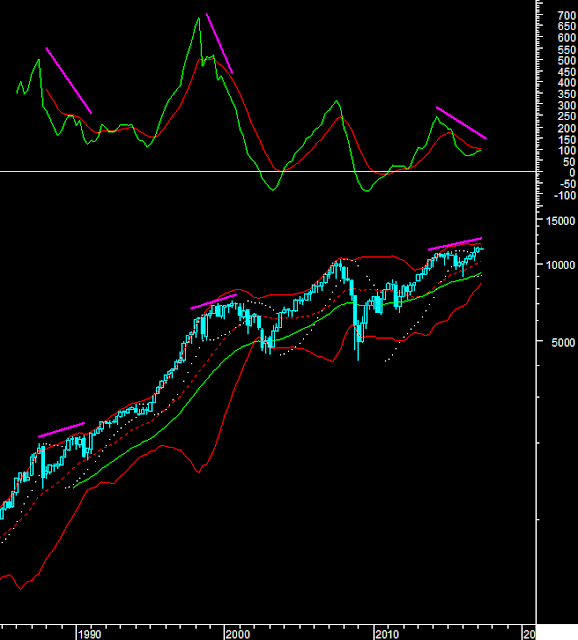

Technical Analysis on NYSE Composite Index, Brazil, Dollar Index, Bond Equity Inversion

NYSE Composite

Quarterly divergences on the NYSE Composite have preceded market corrections

for the US market. The size varied depending on the time period.

Brazil

A Year back I quoted

that I would rather be Long BRIC except the 'I'. From a global perspective that

was right given that the Brazilian Bovespa index almost doubled. So now when

Brazil counts as a completed 5 wave rise where 3<1 and 5<3 I am

concerned. Not long term but for the next year that this market could spend

making a wave 2 decline maybe retracing down to the 61.8% mark near 50000

Dollar Index

The dollar index

opened at the 78.6% retracement mark of the last decline and near the upper

bollinger band, and near the falling trendline from the Dec top. 101.50 is

therefore going to be an important level to decide which side we are headed

from here for the dollar index. The bulls or bears are going to have a run on

the dollar from here. Just get the direction right. Staying below 101.50 I

would think that a major decline starts.

Bond Equity Inversion

I first wrote about this coming inversion at the Dec low in the bond market

however US bonds spent few more months making a double bottom and allowing for

an equity rally. But now the bottom is firmly in place for the coming months

and a bond market rally should keep the pressure on US equities in the coming

weeks.

The near term daily

chart of the US 10 year notes shows the momentum remains in buy mode for weeks

and the rising trendline from the bottom is working as a support.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd