Adam Smith Crude Technical Report

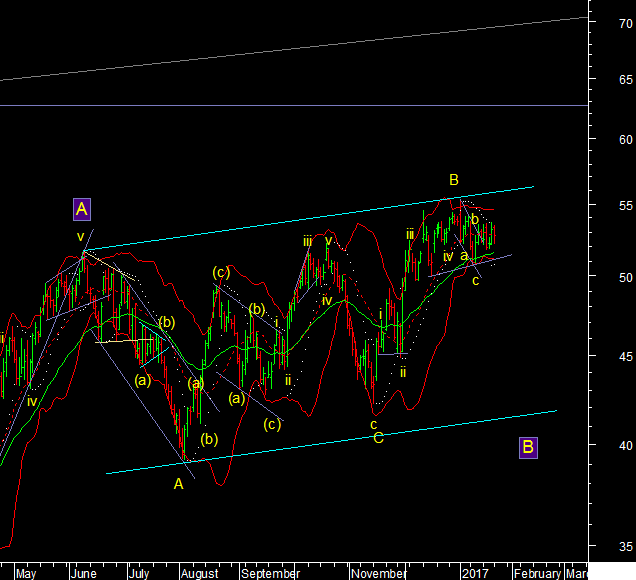

51.50 and 51 are critical support levels for crude. A close below it would imply a change in wave count in favour of wave B forming as a flat. the reason is that after many weeks the daily chart is still not breaking out and momentum is still in sell mode. Positions are getting close to an extreme making the move higher difficult so prices may react. A break of key supports could trigger a move lower towards 45 or 42$ before wave C up can start. On the upside 55.89 can act as a resistance. Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd